Algeria: Efforts to Expand Wheat Production Face Uphill Battle

Summary:

On 23 June 2024, The Algerian Minister of Agriculture and Rural Development declared that the country is nearing self-sufficiency in regard to the production of durum wheat. Durum wheat consists of only 5-8% of global wheat production and is often used to create pasta, couscous, and various types of bread consumed across North Africa and elsewhere.

New deals with Italy and Qatar are set to continue pushing Algeria toward the goal of self-sufficiency. The settled deals with both countries are for the development of agricultural land in southern Algeria. In more detail, Italy will be apportioned 36,000 hectares and Qatar will receive 117,000 hectares, with a remaining 120,000 hectares set aside for Algerian investment.

These recent agricultural agreements come about from Qatar’s successful dairy venture earlier this year and Italy’s favorable outlook upon Algeria’s agricultural potential.

An aim of economic independence is timely, as global production of wheat is estimated to fall due to a combination of climate change impacting land sustainability and socioeconomic development affecting crop choice.

While the Algerian Minister of Agriculture and Rural Development averred that Algeria had an “abundant” yield of wheat, the validity of this claim is contested by a US Department of Agriculture report outlining that wheat harvest was estimated to be low.

Outlook:

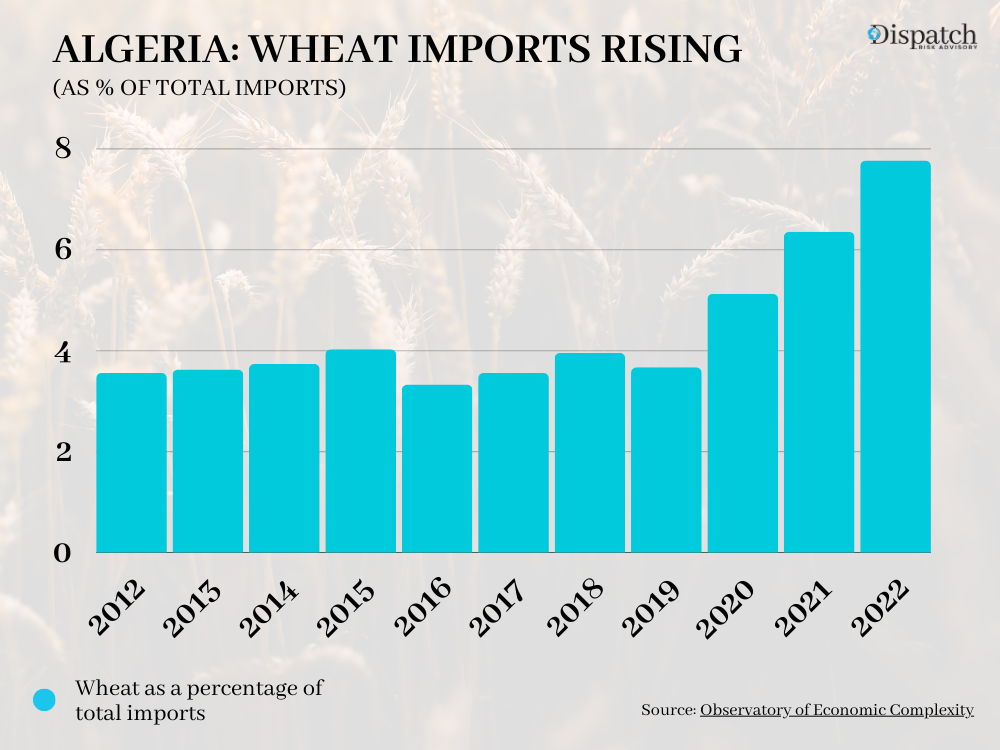

Algeria’s efforts to develop its agricultural industry will likely continue to show limited results due to the ongoing multi-year drought that has limited agricultural production across the region. Due to waning production, wheat imports have more than doubled, as a percentage of total imports, between 2019 and 2022 (see chart).

Self-sufficient durum wheat production would likely mean cheaper wheat products for Algerians, as such goods could be produced locally without the added cost of imports.

However, despite Algeria’s efforts to expand durum wheat production levels, rising consumption of this already heavily subsidized product will continue to put a strain on Algerian consumers.

Explore our services or speak with our team of North Africa-based risk experts.